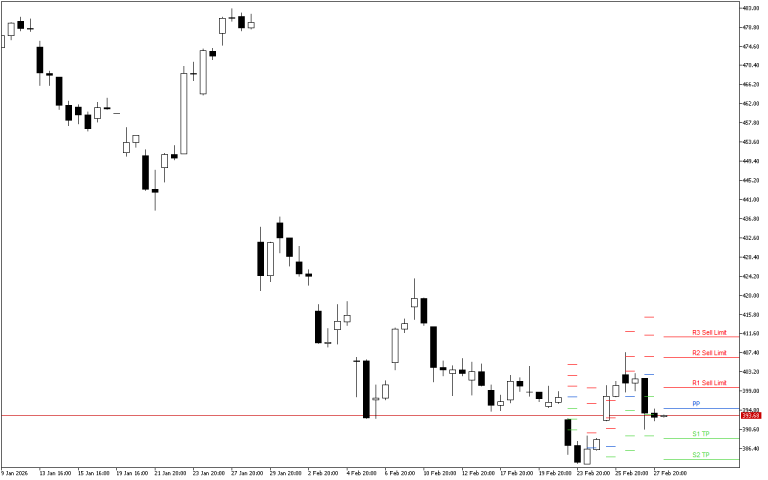

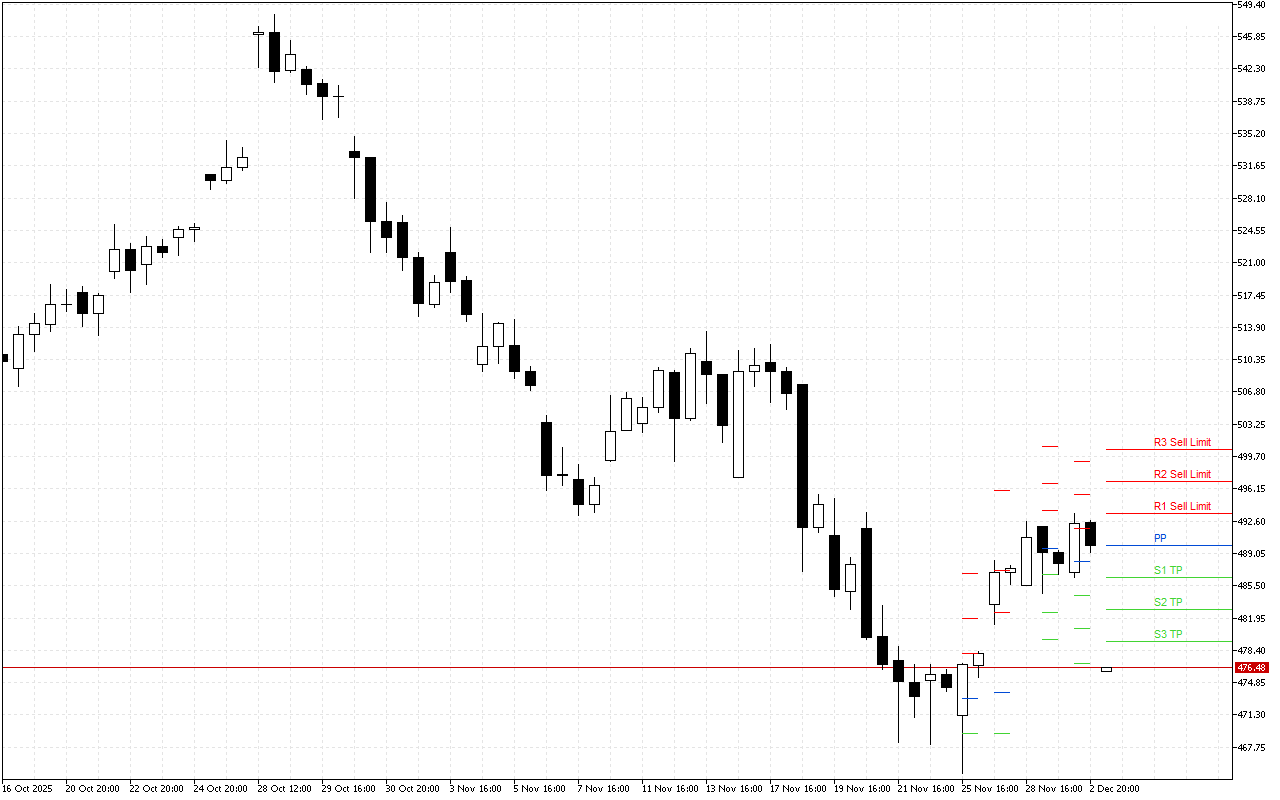

The Pivot Points levels for Microsoft for the U.S. session:

PP: 489.91;S1: 486.41; S2: 482.88; S3: 479.38;R1: 493.44; R2: 496.94; R3: 500.47.

The chart generated the value Pivot Points in the area 489.91. Since the market opened below this level, it indicates a prevailing pessimistic mood. In this case, intraday the trader should tend to look for entry points into short positions.

Trading recommendations:

Intraday the support levels are at S1 486.41, S2 482.88 and S3 479.38.

The market entry signals can be considered intraday on the R1, R2, R3 resistance levels.

The market can be entered both from the PP level and when a price rolls back to the R1, the R2, the R3. The profit is fixed when the price reaches the S1, S2, S3 levels.